Ch 1

Concepts of Governance and Management of Information Systems

Part 5

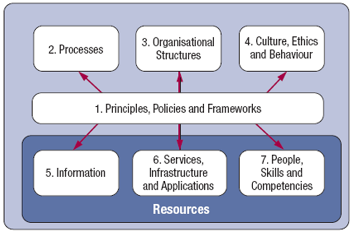

In this session we will talk about seven enablers of COBIT 5 which is also Principle 4 of COBIT 5.

So, we are talking about Principles, Policies and framework in resources areas, organizational structure, processes and culture i.e. A Holistic View.

1.) Processes: Describe an organised set of practices and activities to achieve certain objectives ( i.e. business objectives) and produce a set of outputs ( output may be a product or service) in support of achieving overall IT Related Goals.

Whats the meaning of above highlighted line

Output should be achieved so that IT related goals will be achieved because FINAL goal of IT is also the output enterprise desire.

2.) Organizational Structure: are all key decision making entities in an organization.

3.) Culture, Ethics and Behavior of Individuals and of organization, very often underestimated as a success factor in governance and management activities.

4.) Principle, Policies and framework: These are vehicles to translate the desired behavior into practical guidance for day to day management.

5.) Information: Information is pervasive throughout any organization i.e. deals with all information produced and used by the enterprise. Information is required for keeping the organization running and well governed but at operational level information is very often the key product of the enterprise itself.

6.) Services, Infrastructure and applications include infrastructure and applications, technology that provide the enterprise with IT processing and services.

7.) People, Skills and Competencies are required for successful completion of all activities and for making correct decision ( by management experts) and taking corrective actions.

IN NEXT POST YOU WILL BE PROVIDED WITH NOTES ON COBIT PROCESS REFERENCE MODEL, ISO 27001, ITIL.

CA Mohit Jain

Ph: 08053881595

Email: camohitjain7@gmail.com

Comments

Post a Comment