CH 1

Concepts of Governance and Management of Information Systems

PART 2

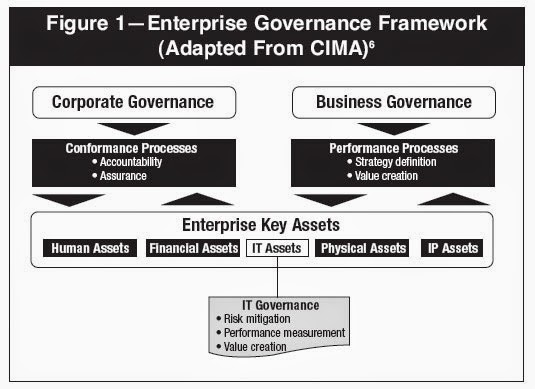

Corporate Governance and IT Governance

As we have already discussed Corporate Governance. Definition of IT Governance is derived from definition of Corporate Governance as follows-

IT Governance is the system by which IT Activities in a company or enterprise are directed and controlled to achieve business objectives with the ultimate objective of meeting stakeholders needs. Therefore IT Governance is a subset of Corporate Governance.

Benefits of Governance

1.) Achieving enterprise objectives i.e. value creation.

2.) Transparent Framework for decision making. (Because jobs are assigned i.e. decision making accountability and also because of single point responsibility)

3.) Desirable Behavior in the use of IT and IT resources.

4.) Implementation and integration of desired business processes into the enterprise.

5.) Providing stability in the organization.

6.) Improving customer satisfaction and business internal relationships by formally integrating the customers, business units and external IT providers into a holistic IT Governance Model.

7.) Effective and strategically aligned decision making.

Note: Students you have to cram this points because there is nothing to explain in these points.

DIMENSIONS OF GOVERNANCE

There are two dimensions of governance.

Conformance and Performance.

Conformance means Corporate Governance Dimension and Performance means business governance dimension.

The conformance dimension is monitored by audit committee. ( for eg: CAG do audit of Government). However Performance dimension (i.e. performance of business) is the responsibility of full board.

As you see in conformance audit committee is the dedicated oversight mechanism but in performance dimension there is no such dedicated oversight mechanism like a strategy committee.

For eg: Remuneration and financial reporting are scrutinized by a specialized board committee of independent non-executive directors and referred back to full board. In contrast critical areas of strategy (which is necessary for business growth) doesn't get the same attention. There is thus an oversight gap in respect of strategy. One of the ways to deal with this lacuna is to establish a strategy committee of similar status to other board committee which will report to the board.

Therefore Conformance focuses on regulatory requirements with compliance subject to audit and assurance while performance dimension is a business oriented view. ( or we can say forward looking view) It focuses on strategy, value creation and risk. Its objective is to help board to make strategic decisions.

Therefore Enterprise governance key message is that enterprise must balance conformance and performance so as to meet stakeholder requirement and ensure long term success.

Concepts of Governance and Management of Information Systems

PART 2

Corporate Governance and IT Governance

As we have already discussed Corporate Governance. Definition of IT Governance is derived from definition of Corporate Governance as follows-

IT Governance is the system by which IT Activities in a company or enterprise are directed and controlled to achieve business objectives with the ultimate objective of meeting stakeholders needs. Therefore IT Governance is a subset of Corporate Governance.

Benefits of Governance

1.) Achieving enterprise objectives i.e. value creation.

2.) Transparent Framework for decision making. (Because jobs are assigned i.e. decision making accountability and also because of single point responsibility)

3.) Desirable Behavior in the use of IT and IT resources.

4.) Implementation and integration of desired business processes into the enterprise.

5.) Providing stability in the organization.

6.) Improving customer satisfaction and business internal relationships by formally integrating the customers, business units and external IT providers into a holistic IT Governance Model.

7.) Effective and strategically aligned decision making.

Note: Students you have to cram this points because there is nothing to explain in these points.

DIMENSIONS OF GOVERNANCE

There are two dimensions of governance.

Conformance and Performance.

Conformance means Corporate Governance Dimension and Performance means business governance dimension.

The conformance dimension is monitored by audit committee. ( for eg: CAG do audit of Government). However Performance dimension (i.e. performance of business) is the responsibility of full board.

As you see in conformance audit committee is the dedicated oversight mechanism but in performance dimension there is no such dedicated oversight mechanism like a strategy committee.

For eg: Remuneration and financial reporting are scrutinized by a specialized board committee of independent non-executive directors and referred back to full board. In contrast critical areas of strategy (which is necessary for business growth) doesn't get the same attention. There is thus an oversight gap in respect of strategy. One of the ways to deal with this lacuna is to establish a strategy committee of similar status to other board committee which will report to the board.

Therefore Conformance focuses on regulatory requirements with compliance subject to audit and assurance while performance dimension is a business oriented view. ( or we can say forward looking view) It focuses on strategy, value creation and risk. Its objective is to help board to make strategic decisions.

Therefore Enterprise governance key message is that enterprise must balance conformance and performance so as to meet stakeholder requirement and ensure long term success.

ReplyDeleteHi! I love how informative and great your articles are. Visit for Best Online Law Courses-LedX